2023 IRP Q&A: PNM Public Advisory Process

For Q&A associated with the Gridworks Facilitated Stakeholder Process, please click here or go to PNM.com/FSPQA.

Questions and Answers:

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

We mean diversity in terms of the diversity of employees, including minorities and women, especially in leadership.

Asked by CSolPower on May 25, 2022. View meeting information here.

Initial Response: PNM

This comment speaks for itself. That said, E3 has done a lot of work on regionally integrated resources plans looking at how other utilities incorporate transmission planning; they may be able to give a broader perspective on other resource plans E3 has worked on and how transmission is done in other regions.

We're trying to do the best we can. It's just a very, very complicated way to do generic transmission and generic resource planning. You really need to have the specifics of locations and resources within an RFP.

Initial Response: E3

We would underscore that incorporating transmission planning into a resource plan is a tall task, not to say we shouldn't try to take steps forward to do a better job with it. Definitely, it is a challenge for the reasons PNM has laid out.

PNM continued.

Information on the different mixes of existing resources and the different types of resources included in the study are based on what the individual utilities provided. These are the resources the individual utilities found were the best mix to meet their obligations to their customers at a reasonable cost while also meeting their environmental constraints. In addition to what is economical, they considered what's available within their jurisdictions and what their forecasts are.

E3 continued.

The mix ends up looking a little bit different for each utility, although almost every utility has a large portion of new solar and storage built into their future plan. Each also has opportunities to build in resources like wind, geothermal, and natural gas, and demand response. This covers the big picture.

Asked by a member of the public on May 25, 2022. View meeting information here.

Response: E3

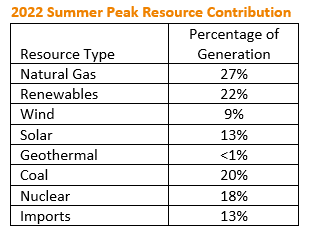

This slide is largely focused on the availability perspective.

This is a summer peak day, a day when the region as a whole is probably relying on the resources it needs at maximum capability in order to meet its needs.

There would be many other times throughout the rest of the year when loads are lower, when there would be an available surplus of energy or even energy that utilities want to be able to sell into the market to avoid, for example, renewable curtailment.

But that's just not the picture we see on the summer peak day.

Also, even as the region comes to rely more and more heavily on this combination of solar and storage to meet its summer peaking needs, you do still have remaining firm resource needs. Given this amount of solar, storage, wind, demand response, and hydro that is built into the utilities’ portfolios, there is still a pretty significant need for firm resources, including any flavor of nuclear, coal, or natural gas that can be dispatched on demand and for sustained periods of time.

And we see that being true through 2033. A common finding that we've seen in all of our work, even as we push the envelope even further: Some form of firm capacity will be needed to maintain reliability, even as the grid approaches 100%, or really ambitious targets for renewable or carbon free resource integration.

Asked by a CSolPower on May 25, 2022. View meeting information here.

Response: E3

The study represents the utilities’ current or previous resource plans, including the capacity of different resources. Here, you're looking the amount of installed capacity within the portfolios, which is a different picture from the amount of energy that these resources generate over the course of a year—something more directly linked to the sort of climate impact that any one of these portfolios might have.

Regarding an earlier question about the dispatch of energy storage and its treatment in the study, an important qualification for this entire exercise is that E3 modelled the southwest as a whole, requiring us in a study like this to make certain assumptions as to how effectively each of the utilities can share its pool of resources with others, especially as the grid enters into more tight conditions.

And so, what this analysis represents is essentially, in some respects, an optimistic perspective on how the total portfolio of resources within the region could support the total needs of the region. The reality of our world today, however, is that we're not perfectly in a fully optimized market, and it is the domain of each utility to assess its own loads, resources, and exposure to the market under loss of load conditions.

So, looking at this on a utility-by-utility basis, you might end up with slightly different answers than we found in this study, but we believe our general findings are valid.

Asked by CSolPower on May 25, 2022. View meeting information here.

Response: E3

Yes. That's a figure that's definitely in our technical report.

On the previous question around transmission, because this is a regional study, we didn't include a very detailed representation of internal transmission constraints within the system. So that's another reason that you might think of this as a slightly optimistic view as to the ability of the region as a whole to collectively share its resources to meet the region's needs.

Here (Slide 27) is what the system looks like from the different perspectives of installed capacity, effective capacity, and annual generation.

These are three different ways to think about various aspects of a system.

On the far left of this graph, you see the total installed capacity of the different types of resources across the different scenarios. There is expansion by 2033, in our IRP scenarios, up to close to 60,000 megawatts of capacity. Again, most of that new capacity coming from renewables and energy storage.

In the middle panel, we take that installed capacity, and translate it into effective capacity, or ELCC capacity. This is essentially where we've tried to take those installed capacity numbers for every resource in the system and direct them, based on LLP modeling, to account for what those resources provide to the system, when it's truly constrained, when it truly needs it most. And here you can see that the corresponding bars for the renewables in the storage have actually shrunk quite a bit. What this reflects is the implicit limits on these resources and their contributions to resource adequacy due to variability and duration limits. And in a comparative sense, the remaining firm resources like coal and natural gas get a much smaller haircut on an ELCC basis.

But the picture on the far right is the one that's perhaps the most relevant for the questions around climate and clean energy. That is the question of an annual basis over the course of the entire year: How much of energy is being supplied by these various types of resources? And so, this is a transition that we see occurring.

Given this portfolio of resources. If you look today across the region, we're probably at 35% by 2026 carbon free energy. By the time this transition to this specific portfolio occurs by 2033, you'd have approximately 70% carbon free energy in the system that is coming largely from a mix of nuclear, solar, and wind resources.

Right now, PNM is a little bit ahead of that curve on the energy mix for our portfolio. We're about 50% carbon free right now and expect to be ahead of the curve for the overall region going forward.

Asked by a member of the public on May 25, 2022. View meeting information here.

Initial Response: E3

It affects the planning in a number of respects, some of which are not taken into account directly within our study, and some of which are, certainly, as water becomes more and more constrained within the region. And that may have impacts on economic growth within the region. That's something that you would expect to see show up within utilities’ load forecasts--their expectations for future economic growth.

We've taken previous load forecast from utilities at face value, so we haven't made any assessment or judgment as to how water use within the region might impact those forecasts. But we think that is something that we would expect utilities within the region to be thinking about.

On the supply side, the risk of drought is something that we did try to think about and factor directly into this work. Essentially, within a model like this loss of load probability model, we have some representation of how much energy is available from the region's hydro resources. And the amount of energy that's available, you can imagine, is a function of what the underlying hydro conditions are.

What we tried to do, and this is based on input that we've gotten directly from the Western Area Power Administration and the Bureau of Reclamation, is characterize the relative risk of severity of drought in a probabilistic way, such that there's some probability in our model that you end up in a really critical hydro situation that reduces the value of the region's hydro resources. In some cases, you may be in a more normal condition on a relative basis, and you have a little bit more capability. So, on the supply side, that’s how we would expect that to come into play.

Initial Response: PNM

From PNM’s perspective, looking at the resource plans that were in our 2020 IRP and the types of resources we're looking at now—and this is pretty true broadly across the West—the new resources that are coming on board are much lower water use resources than the resources that are being retired. So, when you think about coal plants have steam boilers being retired and replaced with solar storage, maybe aeroderivative, and natural gas turbines that run very infrequently and that don't require much water, the net water usage for electrical power generation is significantly decreasing, say, for any entity building a pumped hydro plant or something like that.

Asked by NM RETA on July 27, 2022. View meeting information here.

Initial Response: PNM

We can certainly take that [question] back. It's not something that we have done in the past. We can certainly take that back and see if it's something that we can go ahead and include in a presentation going forward. That does remind me there was a previous question about presenting historic peak information. We do have a filing we make every year--it's our Case 3137 filing. It shows a load and resource balance, including a forecast for peak each year. So, we will post a summary of that.

We would note that there are differences in the way resources are accounted for as well as the contributions of different resources over time, as folks have probably gathered from previous presentations on ELCC [Effective Load Carrying Capability] that resources will change as a function of both system conditions and the penetration level of given resources on the system, as well. In the last IRP we move from installed capacity accounting for thermal resources to force capacity accounting. So, you'll see some differences in the way the numbers are represented. Take that into account.

You can also go to the [Public Regulation] Commission's website to search for the Case 3137 and pull out those filings we make each year to take a look at what the loads and resources tables are showing.

PNM Update:

Asked by a member of the public on December 15, 2022. View meeting information here.

Response: PNM

Setting aside things like gas taxes for vehicles and things like that, if you're talking about all electric fleet, that's a bit aside from what we would do here at PNM. The PNM customers at least pay a gross receipts tax on their electric bills, so that would be applicable to our total revenue requirements.

As long as we're recovering our overall revenues, if any individual customer reduces or changes their usage patterns to optimize their costs, that would change the gross receipts taxes to the State of New Mexico a little bit. That's something that needs to be kept in mind as to how the legislature is going to look at what their revenue needs are going to be relative to the overall gross revenues collected by all the different businesses throughout the State.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

There's a lot happening in this area: How are we thinking about how the system will interact with customer owned storage or other devices? Or are there other ways that the utility can partner with customers to ensure that they are as involved as possible with the transition towards carbon free?

So, you might have seen some commercials out there—of a truck that can plug into the house and can light the house in the event there's a distribution outage. So, there are two-way chargers that are going to be available to allow an electric vehicle to charge or discharge back.

You can also have behind the meter storage. Some of the questions to consider:

If a customer is paying for behind the meter storage, they may want to use that to optimize the benefits from that against their utility bill, and that may not be the best thing for the system.

Or does PNM then open up programs—something we are looking at—where we could either incentivize a customer to sell us the ability to utilize, say, 50% of their battery for the benefit of the system.

Or could there be utility programs where the utility does something, to start doing more distributed energy resources that may or may not be utility owned, but we can then manage and figure out the proper incentive mechanisms to ensure that we can operate those for the benefit of the system -- and not necessarily focusing on tariff optimization.

We have a completely above the board approach as we are going into this transition. We are considering AMI [Advanced Metering Infrastructure] and grid modernization (grid mod) as well as distributed energy management resource systems.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

PNM has had discussions with big name automobile manufacturers about pilot programs in terms of dedicating a fleet of vehicles to using two-way chargers to look like a large battery from the utility’s point of view. If we go back three or four years, the biggest hesitancy from the automobile manufacturers was on the warranties of the batteries; they're starting to get over those trepidations.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

If we're thinking about this from the reliability perspective, there are probably things that we can do with distributed resources. That would mean considering micro grids or things we could do to prop up specific areas of the distribution system to be a bit more resilient and reliable. There are things going on right now like that--maybe at the edge of a feeder or something similar.

We will do our best to cover this issue in this IRP process.

Regarding the IRP, we're looking at things from a bulk transmission level. So, we're not seeing any individual distribution feeders. We have to understand what the aggregate effect of all of the distribution and distributed energy resources are and incorporate those.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

If you mean allowing enough feeder capacity and reverse flow to come from the distribution behind the meter side back onto the PNM system, that's certainly a problem we're facing right now. There are some feeders that are getting to the point where they can't support any additional behind the meter solar.

There are ways we can deal with these issues, and PNM’s distribution planning department is working on the ability to add storage or other things to try to alleviate some of those constraints. All options [are] on the table, and the grid modernization and distribution planning groups are working on say, if they're exporting that much power, how do we then examine that from the bulk transmission level?

Update: PNM

See slides from Grid Modernization meeting held October 17, 2022.

Asked by Sandia National Laboratories on April 28, 2022. View meeting information here.

Initial Response: PNM

We are allowed to talk about rate design in the IRP process, and we did in the 2020 IRP, with a load forecast scenario that looked at very aggressive time of use pricing rates and showed what the anticipated impact to our load forecast would be based off of that time of use rate shift that would make requiring AMI to implement that type of behavior likely.

Going a step further, ‘How are we going to look at the rate designs for electric vehicles?’ Considering perhaps a super off-peak rate during high solar production to influence when electric vehicles will be charged is certainly something that we should be considering.

One of PNM’s requirements, going forward, starting next year, is to show that we are serving our customers with an averaged carbon intensity of 400 pounds per megawatt hour or less over the course of the year; that goes from 2023 through 2031, and then drops to 200 pounds or less in 2032.

And so, one of the key things that we learned in this last planning cycle is when you get to 2032, when you have that step down from 400 pounds to 200 pounds, it's really about decarbonizing the off-peak hours. And if you're not incentivizing electric vehicles to be charging when the sun is shining, you’ve got additional solar. It creates a much larger problem to try to decarbonize the off peak if you're adding load in the long peak.

Update: PNM

See slides from December 15 meeting for discussion of future rate design.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

We will need to see some greater advancements in the control systems for energy storage: the ability to make sense of all the simultaneous decisions that could be made. There are over a dozen different use cases for energy storage in terms of different values that they can provide. And trying to figure out which is the right one, in the moment, is something we doubt humans can do. We're going to have to make sure that we've got algorithms that can do it and in a very intelligent way.

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

The specific concern raised about the 2020 IRP was that some thought that the load forecast by the time we got out to 2040 was wrong. We had a lot of different load forecast scenarios. Granted, the further out in time you go, the more uncertain forecasts are. We think we're using industry best standard practices for load forecasting, but we can have a conversation about it.

We are scheduling a technical session with PNM’s load forecasting group to discuss all the parameters, and, if there's a different load forecast scenario that needs to be considered, we can have them generate one and run it through the portfolio model.

Another topic that was raised in 2020 was renewable resource cost development. Perhaps folks didn’t understand exactly how we develop renewable resource cost assumptions. We can go through in detail what we did and if there are alternative methods. Something else might be more appropriate, so let's figure that out.

And the same thing would go for other candidate: resource technologies. We recently issued two requests for information (RFIs). We did one very similar to what we did at the outset of the last planning cycle, where we were asking for new and emerging technologies to look at things that would help us to decarbonize the system. There are no limits on whether it has to be a utility or supply side resource or demand, right demand side resource, or distributed energy resource. We're hoping to see the whole kit and caboodle in terms of the amount of information that we receive.

We also recognize that there are some technologies that take a long time to develop. In the last planning cycle, there were two or three long duration storage projects that typically take five to 10 years or longer to be developed. And so, we put out a second RFI to try to get more specific information about not just general technologies, but also specific projects that may have long lead times. The RFIs are due June 15 and respondents’ updates by September 15.

The deadlines for the RFIs correspond to when we want to bring the responses back to our stakeholders to discuss these different technologies and resources, and how we can incorporate them into our modeling protocols, making sure that we have the ability to run them as resources for load serving requirements in our model when we start doing the full scenario analyses in the September-October timeframe.

The long duration storage RFI and also hydrogen resource modeling were some issues that raised in the 2020 IRP comments, so we'll want to discuss those. We've been doing some additional testing and modeling -- R&D -- within our own groups. We can talk about that as well as general ways these things are modeled if there are other assumptions about them. For example, one question was about how much water does it take to make hydrogen and does PNM have access that kind of water.

Distributed resource modeling is on our list for discussion as well. We want to make sure we talk about that as much as we can but, again, that one gets a little bit tricky because the IRP is at the bulk system level, not at the individual feeder level. But we do have to make sure we can figure out how we account for all of those DRs when we are designing a least cost plan.

Regarding scenario tree development, I was explicitly thinking about the Four Corners Power Plant Thinking about the different scenarios and sensitivities that we're going to need to run, how are we going to model the existing resources? What were we doing with our existing resources? Is that the best use of them or the most appropriate way to consider the existing system?

Asked by CSolPower on May 25, 2022. View meeting information here.

Initial Response: PNM

We will absolutely incorporate this idea into PNM’s grid mod plans--more customer participation, communications equipment, or real time, smart meters and smart chargers, for example—so that residents don't just return home from work or errands, plug in their cars, and start charging at the wrong time of the day.

Most people have smartphones now that charge slowly overnight but charge really quickly at other times. We can use these same types of functions for electric vehicles, where perhaps a commercial entity with a fleet of electric vehicles would have a charging infrastructure and use it as a battery, as needed, for the entire grid. We must figure out how to price that type of program and decide the kinds of incentives to put in place.

If you're trying to figure out how to decarbonize the entire economy, it might start with the electric sector. Once you get the electric sector emissions down pretty low, you've still got a lot of emissions coming from transportation and natural gas for heating homes, for example. And once you get emissions out of the electric sector, you've got to replace those other forms with electric cars and other such things.

We will discuss this issue at the upcoming Grid Modernization meeting.

Also, we will cover load assumptions regarding electric vehicle adoptions in the Load Forecast presentation.

Update: PNM

See slides covering Grid Modernization (presented at the meeting held October 17, 2022), and the Load Forecast (presented at the meeting held December 15, 2022).

Asked by a member of the public on May 25, 2022. View meeting information here.

Initial Response: E3

We definitely are seeing a trend within the industry towards customers who choose to put solar on their rooftops are also beginning to choose, in some cases, to pair or co-locate battery storage behind the meter. To some extent, when it comes to resource adequacy or reliability, that behind the meter storage might be seen as somewhat of a substitute for the grid scale storage, in the sense that its technical capabilities are aligned or more similar to what a grid scale battery would give you.

That may be technically true, but it may also be optimistic in the sense that it would rely on that customer to use their battery in such a way that's completely aligned with the utility’s needs. And what we'll often see is that customers do choose to use their batteries in ways that are more consistent with the price signals they receive through their tariff or their rates.

So, in that sense, as the portion of storage that's behind the meter continues to grow, there's maybe a need, if we want to get as much value out of those storage resources as possible for society as a whole, to ensure that tariffs and rates are well aligned with utilities’ needs and encourage the right types of behavior when it comes to how those resources are operated behind the meter.

Initial Response: PNM

The way that we would need to look at the distributed resource additions is that they can take the place of some utility scale resources, so long as the utility is able to manage those resources through a distributed energy management system, or otherwise send out completely aligned price signals with the current state of the system. If you've got real time pricing, or advanced metering infrastructure, customers know exactly what's going on with a system’s prices, as opposed to legacy block rates that don't necessarily align price at a specific moment in time with the way the system is being operated.

If you can align the way that the distributive energy resources would work in conjunction with the rest of the system, they can take the place of some of those utility scale resources that are part of our grid mod discussions.

You could see it in the form of micro grids, or in a number of different ways. But getting customers to participate and act in a way that's beneficial for the system, not just beneficial for themselves, is the key to ensuring that the distributed resources are really taking the place of some of the utility investment.

Perhaps it will be utility incentives, or utility programs that customers can take part in in order to participate that way. But there are a lot of mechanisms we could consider but we will have to align the customer incentive and customer behavior with the utility system’s perspective to ensure whatever mechanism works.

Asked by a member of the public on June 8, 2022. View meeting information here.

Initial Response: PNM

Yes. Different load forecast scenarios will be part of the July 6 presentation.

In the 2020 IRP, along with looking at increased penetration of electric vehicles, we also did some load forecast work on increased adoption of building electrification. In this IRP, we've also been doing some work in terms of modeling. We did hydrogen last year, and we did it in a simplified way, where we assumed a hydrogen economy.

An alternative is modeling electrolysers [hydrogen generators] themselves, the loads that they would add, and, of course, producing hydrogen. You are going to have electric loads associated, though, so we are modeling those more explicitly.

We also want to do even more rapid transition towards building electrification, if we assume that everything has to be electrified by 2043, or 2042, which is going to be year 20 of this IRP.

We will be doing transportation electrification, at least three different scenarios or sensitivities, in terms of the load forecast, and how it would be affected by electric vehicle charging. We will also have the building electrification scenario or sensitivity. And if there are other things stakeholders want to consider, then, absolutely, we can figure out how to work them into the IRP.

Update: PNM

See July 6 presentation and December 15 presentation for load forecast topics.

Asked by a member of the public on June 8, 2022. View meeting information here.

Initial Response: PNM

We will explore this topic under grid modernization, and PNM’s distribution planning team will also present some of their ideas on distributed resource management at an upcoming meeting.

Some of this planning will also come down to how the interconnection processes. What makes the most sense? For example, if something is behind the meter, or you have a smart inverter that is never going to be exporting back onto the grid and is just covering the load that's behind the meter there, you don't have to go through a FERC work desk interconnection process, as you would if you were actually exporting back onto the grid.

So, depending on the penetration levels of those distributed resources, as well as how you might be able to integrate everything back up into a centralized, distributed energy management resource system, you may not actually want a lot of counterflow back into the system. So that's another piece we encounter now; it's probably because of net metering rates.

So, the systems are oversized to dump power back onto the grid. But in the future, you might want to look at more as well: The resources behind the meter should be really just serving the load behind the meter.

These are important things to keep an eye on. How can we begin to formulate AMI ideas about how best to work together?

The distributed energy piece is going to be a big one, and we see distributed resources growing. There is no denying that. It makes sense to ensure that distributed resources are done in a way that maximizes the value to the system and that the system stays resilient and provides the value to the folks who are spending the money on it.

We are discussing this internally in PNM and are trying to figure out the best way forward. Some of this planning will be in a PNM grid modernization filing later this year.

Update: PNM

Also see slides covering Grid Modernization (presented at the meeting held October 17, 2022).

Asked by WRA on July 6, 2022. View meeting information here.

Response: PNM

This is something that we'll dive into much more detail in a future meeting--probably along the lines of grid modernization (grid mod) and distributed resources. It's both. As we move the system forward, if we want to get to the fully decarbonized system, unleash the power of our customers, and make sure we're doing everything we can to move this forward, there's going to have to be incentives for behind the meter, customer-owned storage.

Having those incentives right and having those hooked into a distributed energy resource management system, so that the utility operators are actually the ones who can control that storage to some degree is important because the more we align the operation of behind the meter resources with the system requirements--and not individual customer requirements--the more those resources can offset the larger utility scale transmission side and resources.

We're also going to need to have utility-owned distributed source storage on our side of the meter at different places, depending on the location and the customers. There may be advantages to the utility owning and having it on its side of the meter versus on the customer side. It may be both. There is also going to have to be utility scale storage; you're going to have to have it in the load pocket; and you're going to have to have it out near resources.

We envision this as using storage as the way to manage the dispatch of the system to manage reliability and to manage the efficient use of the transmission and distribution system. There's going to be so much storage on there and so many different components of it, that it's all going to have to be worked into computer algorithms--using AI and other things to make sure that we're able to manage this all--in real time.

We don't think you want to count out any of those options. We need them all in order to make sure that we can manage the system reliably and cost effectively and move the decarbonization path forward. We can't eliminate any of our options right now.

Asked by NMPRC on July 6, 2022. View meeting information here.

Response: PNM

Yes, if everything could be interconnected, efficiently, and if we can alleviate the constraints. Our PNM subject matter experts who developed the forecast will do a presentation on it.

If there are things that need to be done to the interconnection process that can be overcome, we will need smart meters--as more and more of distributed resources are added, we will have to have a view into the edge of the system right up into the customer points. With smart meters with AMI we will be able to manage renewable production and customer usage by each individual meter.

In order to make sure that our operators are able to manage the system effectively, they can't be blind to what's going on behind the customer meter. They have to be able to see that, especially, if this adoption rate is what we see materialize, it would represent approximately 1250 megawatts.

Right now, we're a 2000-megawatt system, and if we have approximately half of the resources of the system behind the meter our operators will have to have visibility in real time to make sure they can operate the system.

Asked by a Member of the Public on October 17, 2022. View meeting information here.

Response: PNM

That's greenhouse gas. So, we're talking about how we are trying to empower customers to take more control over what their greenhouse gas footprint would be. And that could be from putting more rooftop solar or storage directly on their side of the meter, or it could be enabling additional reductions in their greenhouse gas footprint by allowing for more electric vehicle infrastructure and a number of other things-- just controlling their overall energy consumption in a way that's more beneficial for the system through getting additional real time information from the advanced metering infrastructure and other such things.

Asked by InterWest Energy Alliance on October 17, 2022. View meeting information here.

Initial Response: PNM

We will get back to you on that. We're not sure exactly how these other 78% of utility customers are doing AMI or things of that nature. We will say that AMI is going to give us more information and it’s the way we utilize that information that's going to be important.

For example, time of use rates or time of day rates are a tool in the toolkit. It's not a silver bullet that's going to magically cause customers to change their behavior and completely overhaul the entire system in a more efficient way. We know that, typically, electric usage is relatively inelastic. So, a lot of the efforts also must be done through education and other such things.

PNM Public policy/legal continued.

We're not early adopters. Obviously, nowadays, there are a lot of other states that have already done this, and we have the advantage of learning from some of what they've done. Our consultants have had years of experience, as well as experience working with DOE to develop some of their standards and their planning.

We at least have some ability to reflect on what has not been done well, and make sure that we're incorporating best practices, which we think we've done in our robust plan.

PNM continued.

We'll have a look at all of the things that are typed in the chat window [during this session] and will take a look at that article. We don't think we can compare and contrast PNM’s plan going forward to what other utilities that have already put AMI out there have done or failed to do.

Asked by InterWest Energy Alliance on October 17, 2022. View meeting information here.

Initial Response: PNM Public policy/legal

Our grid modernization application focuses on the distribution side, but we do recognize that that is one of the aspects that the Commission can consider. That's in the statute.

Our testimony in particular does address that piece of it: it discusses what our current efforts are with regard to regional transmission discussions. When we were discussing the merger, which is not part of this discussion, but we as a company did make a commitment to have discussions with our regional partners to try to join or have discussions about some kind of a regional transmission organization.

So that's still something that we have been keeping informed about. We have participated in some regional meetings in Colorado related to regional efforts.

So even though this particular project or plan doesn't include transmission upgrades--it is focused on distribution--the RTO (Regional Transmission Organization) discussion is still part of what our overall efforts are as a company. We have also addressed it in our testimony in the application.

PNM continued.

We are currently actively involved in a number of different efforts exploring various regional transmission, organization, market design, things of that nature. In particular, PNM is participating in what's known as WMEG (Western Market Exploratory Group). Nick Philips, head of IRP, is chairing the subcommittee on resource adequacy and generation investment. There are other committees on market design and things of that nature.

Most of those efforts are looking at how you would implement a regional transmission organization or a more centralized market structure in the West but with a focus on sometime in the 2030 decade. These things are not going to happen overnight. They're going to take time.

PNM is one of the smaller utilities out there. In fact, we're either the smallest big utility or the biggest small utility. And these types of organizational shifts in the West are going to have to be led by some of the larger organizations. PNM can't make it happen by itself.

There are a few different things to think about. One, there's the Western resource adequacy program or WRAP that's looking at trying to do some more concentrated efforts around resource adequacy planning among Western members. The effects of that could flow into a couple of different market-based designs. One is the enhanced day ahead market or EDM, done through the California ISO. That will be available to EDM participants to do day ahead market scheduling for energy - that's not capacity. There's also an SPP (Southwestern Power Pool) West being designed.

And again, all of these are pretty well in their infancy stages and they're going to take time to develop. And it's going to have to be a look at where each and every one of these potential entities in the West would want to go.

There are over 30 different members exploring the potential market structures through WMEG. But again, the timeline really is focused on what could be done to deliver a market potentially sometime in the 2030 decade.

Asked by a Member of the Public on October 17, 2022. View meeting information here.

Initial Response: PNM

So, the overall size of the system that we would need in order to serve our customers reliably, just thinking about the amount of, let's call it, nameplate capacity that we'll have on our system to meet our renewable energy requirements, decarbonize the system, and keep the system operational from a reliability point of view, we're going to need to see somewhere in the neighborhood of maybe four to six times the amount of nameplate capacity of resources relative to our peak load.

Right now, we're a 2,000-ish megawatt system. We actually hit a new all-time retail peak back on July 19 of this year: 2,071 megawatts. We have just a little over 4,000 megawatts of total resources right now to serve our system reliably. That includes a reserve margin, of course. But as we go further down the decarbonization path, with renewable resources, you can't always expect 100% of their output, especially not when you need it.

A solar facility, as an example, might give you across the course of the year 32% of its nameplate rating in terms of annual energy production, or what's known as capacity factor-- wind resources are maybe a little bit higher than that, depending on where they're sited. But compare that to, say, historically a nuclear plant or a coal plant or something that you can just turn on and run at full output, virtually for all hours of the year, you're going to get a lot less energy out of some of these renewable resources. You're going to have to have a lot more of them in order to meet the renewable energy requirements. Then we're going to have to have a lot more other resources in order to balance the system in terms of storage or other flexible generation to make sure that we can dispatch the system in a reliable way.

Going forward, we're going to need to have something in the neighborhood of four to six times the amount of total nameplate megawatts on the system to meet our capacity and energy requirements.

Now, it's not to say it is all going to be utility scale or utility sited. The more that's done on the distributed level--reduce requirements or utility scale operations, so long as they're able to be dispatched by the utility or they can be integrated in the system in an efficient way.

And that gets down to what we discussed earlier in the presentation on the distributed energy resource management system.

We're also going to think about increasing the amount of transmission that's available potentially, in order to deliver those resources or siting storage in a way to make use of the existing transmission system more efficient and start thinking about potentially energy only deliveries. We do have enough transmission capacity to deliver resources to load under N-1contingency conditions right now and serve our system reliably. But that means you may have to think about the way you deliver resources a little bit differently. We don't need to deliver every single megawatt of renewables as they're produced if we can store them and deliver them at different points in time when we need them.

Now, that's just talking about kind of planning 101.

When we start getting more into the resiliency aspect of things, as we have talked a little bit at a previous presentation about a supply side resiliency study that PNM does, one of the big takeaways there was if we want to take for example, the 200 megawatts of Four Corners out of the portfolio, and we wanted to replace that with an all renewable storage portfolio, we could do that under traditional reliability planning, by using a combination of 100 megawatts of four-hour storage, 50 megawatts of two-hour storage, and about 100 megawatts of solar resources.

But when we looked at that under some extreme weather scenarios and looked at how the system would perform under outage analysis, if outages were to occur, what we saw was that short duration storage plus renewable portfolio performed much different than a firm dispatchable type portfolio.

And if we want to align the characteristics, not just on a frequency of outage bases, but also on a magnitude of outage basis, the durations of those storage devices would have to be increased from two- and four-hour to 14- and 16-hour storage. So, significant increases on the overall dispatch.

And you can think about that in terms of the overall megawatt hours of storage that we would need on the system to make sure that we're able to respond to outages in a certain way.

So, it's not to say that you have to just add duration, you can also add power electronics and increase the capacity, both the charging and discharging rate, so long as you're adding that amount of volume of stored energy. But we're going to have to add more and more resources to make sure that we can provide the same characteristics of our traditional system and just take the carbon out of it.

To get back my initial point, four to six times the amount of nameplate is probably the minimum. You might see it has to be more than that. And it's going to have to be done in concert with distributed energy resources, taking those into account, looking at how we deliver resources, both the distribution and the transmission level, and how we're going to intelligently site storage to maximize the efficiency of the system, both of the transmission and the distribution level integrated from customers through distributed energy resource management systems. And looking at the supply resiliency side of it as well.

PNM Distribution continued.

What we like to think about in our distribution team is the deployment of these technologies that's in grid mod, and really where we're going with the integration of more renewables into the system, it's all about data, and then it's managing energy flow in two directions.

And so, if we have the data, we're able to optimize the design. And when we can optimize the design, then that is really taking the resource to its optimum level, and then at that point, we will have to add additional, maybe it's transmission, maybe its distribution substation, just depends on how the growth is occurring. And really, what's driving a lot of the transformation is growth.

And the other piece of this--the name of the game--is location is critical. So, where those energy resources are located, where the customer is located for the new load - that drives the resources or the additions to the system that may be required or not required, depending on what we can, if we can site energy storage or site resources near load.

PNM continued.

And then how efficiently that load utilizes the system is important as well. So, we think about the additional transportation electrification load or additional building electrification load, all those things that go towards decarbonizing the full economy.

We want to incentivize those loads to appear on the system at times where they're not going to add to the stress of the system.

So, if we can have charging loads, for example, occur during the middle of the day when solar output is at maximum, and we might be either in a position where we're having to curtail, sell off system, or store that energy, and it can be utilized by electrification loads, that's not necessarily going to add additional resources to the system. It's using the existing resources more efficiently.

But if people are coming home and charging their electric vehicles at times where we're already trying to manage a net peak load that could require us to add additional resources in order to make sure we can serve that load reliably.

So, there's, how efficiently the loads are utilizing the system, how are we incentivizing customers to participate in the right ways? We want to make sure that we're allowing all of this to happen. This brings to mind the adage that the utility industry is 5% of GDP but it's the first 5%.

In order to do all those things going forward that we want to do to decarbonize the entire economy--transportation, electrification, more building electrification--taking carbon everywhere else out, we have to have a strong and reliable utility in order to deliver the carbon free energy that we're going to be producing going forward to our customers and allowing them to utilize that throughout the rest of the economy to further decarbonize other sectors.

Asked by a Member of the Public on October 17, 2022. View meeting information here.

Initial Response: PNM Distribution

Let's remember that today, if we have an outage, the way that our operations center knows of the outage is when customers call in; we don't have visibility to an individual customer. So maybe the first advancement with AMI (Advance Metering Interface) is that we will have real time energy information and we'll know if we have outages at a customer level.

So then, if we look at the blue chevrons right in the middle of the screen (Slide 11), there's a long bar there that runs from year two to year six; it's a distribution automation. So, we have the automation, sectionalizing, and bulk control. And then right below that we have the ADMS Fault Location Isolation & Service Restoration, the FLISR.

Those two systems will actually work in concert.

What you'll see in our plan is now, on a distribution level, if there's a fault that occurs, we're going to sectionalize our feeder into smaller subsections so there are fewer customers that are out. That's the sectionalization.

And then the FLISR piece of it is, if the fault occurs, we sectionalize and isolate the fault, and we can restore from another feeder, from another source. That's the FLISR.

So, the outage rates will be much smaller; the fault, wherever it may occur, will be isolated and sectionalized. Our crews and our operations center will know exactly where that fault is so they're able to dispatch the crews to address it in a much shorter timeline. And they're able to go right to the fault rather than having to patrol the entire feeder looking for the fault or the event.

And then all the other customers will be restored until we fix and resolve the smaller section that's out. Then, once that's resolved, we're able to return those customers back to service.

Member of the Public continued.

I guess where my concern comes, is when there's an outage--we have so many--we become so dependent upon these communication systems operating. If the communication systems fail, then many things in the past that have been available on a manual basis then become unavailable to most any level.

So, I need to think about that a little more, but maybe all of you need to think about it, too.

PNM continued.

That's a really good point. So, as our systems become much more intelligent, we're much more dependent upon data. We always design backups into our system as well. So, we have backup control centers. We have backups if we lose communication. So, there should always be a backup and a contingency.

But very good point. Thank you for that.

Asked by Southwest Energy Efficiency Project on October 17, 2022. View meeting information here.

Initial Response: PNM

We certainly are going to start collecting information. Our pricing team has already been meeting with a number of stakeholders in advance of our upcoming rate application filing later this year.

Speaking of a time-of-day pilot program--not to be confused with time of use rates--it is a more succinct rate structure that will try to better align the costs incurred by the utility with the rates that people pay during different points throughout the day. And it is also differentiated by season. We'll be able to talk about that a bit more specifically at a future meeting, but we are going to be rolling out a pilot program for that. This upcoming rate filing and continuing to try to advance that throughout the rest of the rate structure is going forward as more and more AMI gets deployed throughout the system.

But AMI, of course, can't be deployed overnight.

On the load management programs, we currently do offer demand response programs through our energy efficiency plan. That's the peak saver program and the power saver program. And we'll be talking about those and potential other options that may be available in the future at a future meeting.

There are a number of pluses and minuses associated with the programs that are done through energy efficiency. In particular, we want to try to make them available to as many customers as possible and minimize the number of customers opting out of the programs after they've joined.

These are 100% voluntary programs. That tries to keep more customers engaged but, on the other hand, it also makes it so that customers can opt out. And we can't always count on all that capacity for reliability purposes. But we do try to make sure that we make those burdens as flexible as possible to keep more customers engaged.

The power saver program is for residential customers, it's typically for HVAC loads, and it's dispatched cycling through HVAC loads across the system so that not everybody has all their air conditioning turned off simultaneously for an extended period of time, but typically rotating through turning air conditioners off--maybe 30 minutes at a time--for a subset of the overall program population and cycling through those a for a four-hour window. Now those programs are currently set to be operable June through September from 8 a.m. to 8 p.m.

The same applies for the peak saver program, which is a large commercial and industrial program that allows those types of customers to participate. Again, it's a voluntary program.

Combined, we count on about 30 megawatts of peak reduction for those programs towards meeting our reliability requirements. We do have more than that enrolled in the program. Because of the voluntary nature and looking at actual program operations compared to just what the nominal contractual obligations were, there's a bit of a difference there. So, we only count about 30 megawatts towards our reliability requirements.

As far as whether there will be new programs being offered going forward, once AMI is installed, we're always mindful that we want to make new customer programs for as many different portions of the population as we can. As we look at that we know our energy efficiency team--there's an active RFP out right now-- is trying to look at different types of demand response programs, something that might be it would be a bit firmer.

We always take a look at what other alternatives are out there. But we do have to be careful that we're not going to harvest or cannibalize, say, from one program to feed another. We want to make sure that we're not double counting megawatts or double counting things and are trying to make sure that we're serving our customers reliably.

So, you'll need to take a look at what makes sense for these programs going forward--as we've looked at some of the time-of-day pricing rates--and try to align costs in those with where the costs are incurred in our system, looking at where the loss of load probability is on our system, and trying to think about where we want to focus: potentially alterations to the existing demand response program to potentially make new programs to fill in gaps.

The risks and our shift in our system are moving later in the day--in the summer towards the net peak periods, that 5 p.m. to 10 p.m. timeframe, especially in the summer. And in the winter, we see kind of a dual peaking, where we'll start to see a little bit of risk in the morning hours as well as in the net peak hours in the afternoon.

So, as we get more and more information from AMI programs, as we start to see better into what our customers are doing, we will try to offer additional programs. But right now, we do have the two programs we are offering through the energy efficiency programs as well as an active RFP looking at potential new programs or increasing loads on the existing programs, depending on what those prices kind of look like and where we think we could get customers to enroll.

PNM Public policy/legal continued.

On Slide 11, you can see that second chevron under the green one that's basically under Customer Empowerment, which is advanced metering infrastructure. That's really the meters portion that we're talking about. It's going to be about a three-to-three-and-a-half-year deployment. And it's on a rolling basis. So, the meters themselves will have to be physically switched out from the old analog meters, or even in some cases, digital meters to the advanced meters, the smart meters.

And that will occur over time with 530,000 customers in an area--the size of our service territory is pretty big. So, it will take some time to deploy that to all customers.

But in addition to that, at the same time, we have the other areas in blue {on this Slide} which are the distribution upgrades, and then the supporting services in gray that are occurring at the same time.

So, the time everybody is fully transitioned to the new meters would be roughly around the end of year four of this plan, beginning after the Commission makes that decision.

Asked by a Member of the Public on November 2, 2022. View meeting information here.

Initial Response: PNM

Do you mean decentralization of resources or decentralization of load? Could you clarify?

Member of the Public continued.

It just seems that looking far into the future, where the possibility is of people to kind of fork off, requiring PNM or backing up at home with their own batteries, all that kind of thing.

It may be too early, but I just keep wanting to see that somewhere rattling around in our thinking because customers could peel off in different ways. And that could impact the company in many ways. So, it's probably demand.

PNM continued.

Thanks for clarifying.

The way that this is being considered is through our demand forecasts. The IRP, again, looks at just PNM's retail customers. If a customer were to become completely self-sufficient, and no longer be a part of the PNM’s retail system, they would not be included in the load forecast. That's not an obligation we would have to serve.

If the customers are incorporating their own resources behind the meter through additional adoption of behind the meter photovoltaic (PV) rooftop solar, essentially adding their own batteries behind the meter, those are things that we are incorporating through the load forecast.

So, we have a specific component in the load forecast that assesses a forecast of behind the meters: PV adoption. And there's going to be four or maybe five different behind the meter PV forecasts. One of them will be trying to back out all existing PV on the behind the meter PV on the system. One will be assuming there's no new incremental behind the meter PV, Then, there's going to be three different incremental behind the meter PV forecasts.

And so, each of these forecasts can be used as modifications to the overall retail load forecast and would reduce the amount of system requirements that would have to be added and, in turn, reduce the amount of retail sales to support those customers. That would be accounted for--with additional behind the meter storage additions.

Again, that would end up depending on how [those modifications] are operated. If they are operated just on behalf of any individual customer for their own benefit, that would manifest through a change in the load shape in one way.

On the other hand, if we were to look at the establishment, once we have AMI (Advanced Metering Infrastructure), of perhaps a distributed energy resource management system, we can start to model the behind the meter resources as something that has full visibility--not just a load modifier, but a dispatchable combination of resources that PNM could operate or dispatch, through an aggregated system for the benefit of the entire system. Thus, that would reduce the need for additional resources on the system.

Those are the ways we're thinking about it for this integrated resource planning cycle, and we'll have to continue to think about it going forward. Additionally, there's going to be independent forecasts for different building electrification as well as transportation electrification forecasts. And then a time of use, or time of day rate pricing sensitivity that will say, "Well, if enough customers joined this time of day pricing program and modify their behavior, how might that change the overall requirements of the system?"

So, that's the way we're looking at, at least from the supply planning point of view. And we would always keep in mind as well, when we're establishing what the needs of the system are, and we determine that so much solar might be needed, or so much storage might be needed, even if it's coming in at the utility scale, that it doesn't mean it's something that has to be done by the utility. It could always have a part for the customer to enable them to be part of the transition, so long as the resources are dispatched for the benefit of the system, and not dispatched for the benefit of any specific customer.

We know that this has been an ongoing question for years. And we hope that [this response] helps to think about the way we're looking at it this go around, from the integrated resources planning point. The key has to be about just what are we doing for our retail customers? And then how can we take lots of small, distributed resources, and think about how they could be aggregated up to the system level. Because when we're looking at the IRP, we’re always looking at the bulk transmission system; we're not modeling down to the distribution levels.

Member of the Public continued.

Thank you.

I keep raising this because I do see things as being pretty far, some of it's pretty far, out in the future. I'm not expecting immediate answers of any sort. I just want to understand how to think about it. And you're helping me a lot.

Asked by a Member of the Public on November 2, 2022. View meeting information here.

Initial Response: PNM

In 2016, we filed a case for the adoption of Advanced Metering Infrastructure (AMI), and there was a lot of resistance. That case was denied by the Commission, and there were a number of groups and individuals that filed protests. That seems to have changed a little bit.

The Commission, as a part of our grid modernization filing, required us to file our AMI component. If they approve it and they require AMI to be the de facto standard meters of the system, that will be deployed, and it's met with some resistance, we're not sure necessarily what the company would do for individuals who may not want that type of meter.

But we certainly see that going forward. AMI--advanced communications--will be a significant component and part of the infrastructure of the system. We can't decarbonize completely; we can't do all the things on the distributed level--things that we need to do in order to decarbonize--without having that visibility into the edge of the system.

PNM update:

Our Grid Mod filing identifies the opt-out options and fees proposed by PNM – a customer will pay a one-time fee at opt-out, and then a recurring monthly fee for meter maintenance and manual reading. If a customer opts out prior to deployment, they will keep their existing meter; if a customer opts out after deployment, the new meter will be replaced with the same type they had before AMI deployment.

Grid Mod FAQs are posted on PNM’s website here.

PNM is also voluntarily adopting the U.S. Department of Energy’s Data Guard Energy Data Privacy Program Voluntary Code of Conduct. (https://www.smartgrid.gov/data_guard.html).

Asked by a member of the public on April 28, 2022. View meeting information here.

Response: PNM

We will ensure that a scenario that removes BTM-DG [Behind the Meter Distributed Generation] is included in the IRP.

Customers are free to do what they want and what they do behind their meters makes it hard to know what those loads are. We don’t have intelligent meters, and we can’t know exactly what the fully connected load is.

The load the utilities serves is what is seen at the meters by the utility. For those individuals or commercial entities that have BTM rooftop sources, serve part of their load.

Asked by a member of the public on May 25, 2022. View meeting information here.

Initial Response: E3

We built this study around a specific load forecast that was developed based on the utilities’ own assumptions as to the future of transportation, electrification, and such. Our work here represents an evaluation of, given a certain load forecast, the resources that the utilities have planned and have in the ground today that are sufficient to meet that load forecast to a sufficient standard.

That means there is a lot of pressure on the utilities in their load forecasting to make sure that they're keeping up with the trends that we're seeing within the industry with respect to electrification, both transportation and buildings, and that the load forecasts reflect the best future information we have as to the size of those growing segments. As the question alludes, if those dynamics aren't captured in a forward-looking evaluation of how large loads could grow, there may not be sufficient resources developed in the plant to keep pace with those changes.

Initial Response: PNM

We would want to ensure that E3 agrees that part of resource adequacy planning is to ensure that this resource adequacy standard has sufficient room to cover uncertainty around that load forecast and that always carries enough reserves to cover that uncertainty with the load forecast and a number of other variables.

E3 continued.

Agreed.

Asked by a member of the public on May 25, 2022. View meeting information here.

Initial Response: E3

It affects the planning in a number of respects, some of which are not taken into account directly within our study, and some of which are, certainly, as water becomes more and more constrained within the region. And that may have impacts on economic growth within the region. That's something that you would expect to see show up within utilities’ load forecasts--their expectations for future economic growth.

We've taken previous load forecast from utilities at face value, so we haven't made any assessment or judgment as to how water use within the region might impact those forecasts. But we think that is something that we would expect utilities within the region to be thinking about.

On the supply side, the risk of drought is something that we did try to think about and factor directly into this work. Essentially, within a model like this loss of load probability model, we have some representation of how much energy is available from the region's hydro resources. And the amount of energy that's available, you can imagine, is a function of what the underlying hydro conditions are.

What we tried to do, and this is based on input that we've gotten directly from the Western Area Power Administration and the Bureau of Reclamation, is characterize the relative risk of severity of drought in a probabilistic way, such that there's some probability in our model that you end up in a really critical hydro situation that reduces the value of the region's hydro resources. In some cases, you may be in a more normal condition on a relative basis, and you have a little bit more capability. So, on the supply side, that’s how we would expect that to come into play.

Initial Response: PNM

From PNM’s perspective, looking at the resource plans that were in our 2020 IRP and the types of resources we're looking at now—and this is pretty true broadly across the West—the new resources that are coming on board are much lower water use resources than the resources that are being retired. So, when you think about coal plants have steam boilers being retired and replaced with solar storage, maybe aeroderivative, and natural gas turbines that run very infrequently and that don't require much water, the net water usage for electrical power generation is significantly decreasing, say, for any entity building a pumped hydro plant or something like that.

Asked by the Office of the New Mexico Attorney General on May 25, 2022. View meeting information here.

Initial Response: E3

On the risks associated with existing or legacy resources, a model like this relies on assumptions around the risks of outages for all types of resources, existing resources included. And those outage risks are usually based on historical experience. In this study, we've used assumptions that are consistent with utilities’ plans for the outage risks of various resources. In general, what we see with those outage rates is that for a lot of the oldest plants on the system, and in particular, some of the coal plants, those outage rates are higher than you might see with a new facility. And so that is factored into this type of analysis.

And we do, in fact, in this study, apply the same ELCC [Effective Load Carrying Capacity] construct that we use for wind, solar, and storage to those existing resources when accounting for their capacity contributions. So, every one of those resources--whether nuclear, coal, or natural gas--gets its own haircut on its effective capacity based on assumptions around its outage rate.

PNM will discuss outage rate assumptions for its modelling in a future session.

Update: PNM

Outage rate assumptions for modelling were discussed at the January 17, 2023 meeting.

Asked by a member of the public on May 25, 2022. View meeting information here.

Response: PNM

I think there are two different pieces to that, if we're thinking about being able to add water-based resources or about the hydrological resources included in the studies that have reservoirs. Is there a way to take those two closed systems as opposed to open systems to reduce the evaporation?

So, those are things that are being looked at in terms of a few pumped hydro projects that we are aware of. And there are different ways they think about either reducing or eliminating evaporative offtake from the system as a whole: Are you trying to say now that every single water reservoir should be for the entire economy or for water usage for homes or for anything other than power generation? That's a much broader discussion.

If we're going to try to get the entire economy to go a certain way, we've got to stop thinking about individual sectors and start thinking about the cross play between sectors. But that's probably a broader discussion than we have time for in these integrated resource planning forums.

Granted, if we're going to make the best use of our water resources, especially as things are becoming more constrained with more population growth in the West, existing or new hydrological resources in the form of pumped storage is one of the most well-known types of long duration storage you can add to a system; it could really play a role. But if you don't have the water for it, then what's the use? So, we've got to figure out a way to make everything work for us in an efficient and environmentally friendly way.

Asked by CSol Power on June 8, 2022. View meeting information here.

Response: PNM

We do have two RFIs out right now, neither of them is specific to a duration aspect. One of the RFIs is seeking longer duration storage. And that can be anything from maybe five hours—some consider that long; it is longer than four (4) hours, but it could be eight (8) hours, 12 hours, 24 hours, a week, or even longer. We're very open ended in that RFI, and there's no prescribed capacity amount, either.

We're trying to get an idea of what is out there, especially those types of projects like pumped hydro or other things that have very long lead times for the development of those types of resources. Or maybe they're getting to the stage of being commercially viable, but they're still in pilots; we want to understand them and then get a better idea of how the commercialization of those types of resources would go.

The other RFI is more about emerging technologies, and very similar to the RFI that we issued prior to the 2020 IRP to look at those new and emerging technologies that are less project specific, but more technology specific, that we can start to consider over the planning horizon.

The IRP, of course, is about resources and storage capacity durations. Do we need to stop thinking about storage in the duration, but more about the total amount of stored energy that it could offer up? Then, you've also got the capacity side of the equation. Say, we've got 100 megawatts for a battery. Well, that 100 megawatts can be discharged at 50 megawatts, over eight (8) hours.

So, there are different ways you can utilize these storage technologies and make them look a little bit different. But there are going to be times when you might want to have that greater rate of discharge or charging. In winter, there's a shorter window for solar production, so, if we need to charge our storage devices, we might need to have a higher rate of charging capacity, even though the total volume of stored energy may or may not change.

The IRP is going to address how we start thinking about the resources we need to reliably serve our customers in a cost-effective way. I don't think there's a prescribed volume of duration of storage or capacity of storage that we've identified yet. We will be identifying that through this IRP process.

Asked by InterWest Energy Alliance on July 6, 2022. View meeting information here.

Response: PNM

We can certainly take that feedback and try to organize it into a write up in the IRP itself. It shouldn't be too tough to do.

Typically, the more detailed discussion of the weather data and the load forecast development is in the Buildings Appendix C of the 2020 IRP.

Asked by a member of the public on April 28, 2022. View meeting information here.

See PNM's response to this question in Grid Modernization, April 28, 2022.

Asked by CCAE on April 28, 2022. View meeting information here.

Response: PNM

We believe this will impact PNM, and we are going to be taking a look at that much more closely.

We've been seeing a decrease in liquidity of the markets over the last few years and expect to see that continued decrease going forward. If all of the utilities in the desert southwest start having systems that are mainly solar and storage-based with a little bit of dispatchable natural gas for reliability, depending on the timeframes, the systems will become much more correlated in terms of when their risks are going to manifest.

If energy storage is the primary resource used for reliability, especially if it's shorter duration, there could get into situations where other utilities may not want to sell energy out of their stored resources because they would be unable to replenish that energy and use it for themselves later.

So, we do see a pretty big risk that we need to examine going forward related to what the energy markets are going to look like and how those dynamics will evolve as more and more systems go to your heavy deep decarbonization requirements.

Asked by CSolPower on May 25, 2022. View meeting information here.

Update: PNM

We discussed topics related to this question in the October 17, 2022 Grid Mod presentation.

See also the discussion around electric vehicle load in the load forecast presentation from December 15, 2022.

Asked by Office of the New Mexico Attorney General on May 25, 2022. View meeting information here.

Initial Response: E3

On your first question, we didn't go through an exercise of trying to disentangle exactly how much the various factors of load growth versus resource retirements drive the need for capacity within the region. But it's hard to say it's not a combination of both and that both are really significant contributors.

We found that in 2021, the system is already right on the cusp of being at the acceptable level of reliability if you were to use a one day and 10-year standard. At that point, any resource retirements or any load growth beyond that point drive a need for new resources.

Now, in terms of scale, the study points out that by the time we're out in 2033, we're looking at somewhere on the order of 5 to 6000 megawatts of conventional capacity that's expected to retire. So, at the very least, you can imagine that that would be some sort of a bookend or approximation of a portion of the need that might be set by, determined by, or associated with resource retirements.

Asked by a member of the public on May 25, 2022. View meeting information here.

Initial Response: E3

That's demand response programs contemplated by utilities; essentially load that can be curtailed under specific conditions, typically when the system is tight on capacity. Demand response calls are not counted as loss of load events.

Asked by Brubaker & Associates on June 22, 2022. View meeting information here.

Initial Response: AEG

Yes, it is a kind of the catch-all for all the things that don't have a place in the other end uses.

Asked by Sandia National Laboratories on June 22, 2022. View meeting information here.

Initial Response: AEG

Every forecast has error. This is a projection, so it could be over or underestimating the conversion rate. The actual energy efficiencies that occur could be in error, either be too much or too little energy efficiency once we actually get there.

That transformation happens as people are really moving away from evaporative cooling. It could go in either direction. It just depends on which way the actual adoption happens, because we could overshoot it, or we could undershoot it in our forecast.

And with all the codes and standards, there are so many things that are going to come into play in the future that change those adoption rates. There’s electrification and things like heat pumps happening in the in the HVAC space. Lots of little wrinkles.

Update: PNM

Please see presentations on energy efficiency (January 17 2022) and rate design (December 15 2022).

Asked by Sandia National Laboratories on June 22, 2022. View meeting information here.

Initial response: AEG

The short answer is yes. We are collecting information on that kind of conversion from the past. We've done primary research, and we are looking at the saturation of different types of cooling within the residential sector. So, we do have some history to help us make that assumption.

We are looking at a lot of different sources to understand how saturations change over time, and then we will build that into the model. The potential for energy efficiency is changing, as you're seeing more and more HVAC, regular air conditioning coming into PNM territory.

We are also going to rely on national sources and integrate with Itron. They are also making assumptions, using a statistically adjusted end use modeling approach that actually uses indices of cooling and heating.

Update: PNM

Please see presentations on energy efficiency (January 17 2022) and rate design (December 15 2022).